Advertiser Disclosure: The bank card and banking features that look on This great site are from credit card organizations and banks from which MoneyCrashers.com gets payment. This payment may well effect how and wherever merchandise look on This page, which include, by way of example, the get by which they seem on classification webpages.

Resources transfer: As soon as authorized, the ACH initiates the transfer of funds from the payer’s bank account towards the payee’s banking account. This may take place almost immediately or may possibly take a couple small business days, according to various elements such as the institutions associated as well as details on the ACH network’s processing program. (It settles payments four moments a day, but is offline on weekends and holidays.)

eChecks offer a handy way for retailers and consumers, businesses and staff, and small companies to exchange income electronically. How this works:

An additional massive advantage eChecks present merchants along with other little enterprises is their Value-efficiency. Processing fees for eChecks are generally additional reasonably priced than other payment procedures, like credit cards, which might assortment concerning one.

Is there sufficient income while in the account to include this payment? The payment processor operates some essential checks to be sure the transaction seems reputable, then the transaction is often executed.

These payments may also be beneficial mainly because they get rid of the potential of remaining late having a payment as a result of delayed or lost mail.

That’s why some small nearby merchants offer special discounts in case you pay back in money. (OK, from time to time it’s also because they’re a services- or salvage-primarily based company and don’t need to pay out taxes on a sale they Believe Uncle Sam can’t show they made.)

E-checks are intangible, so that you can’t truly at any time eliminate them. In truth, you might have a lot of assist from the pc networks that excel at retaining pay via echeck track of them.

Fork out an Individual. Should you’re shelling out someone, for instance a Buddy, your financial institution’s e-Test service may well Permit you to do so with out ever having possession of their real banking details by using the recipient’s title or e-mail deal with.

A financial institution GIRO transfer is commonly Utilized in Europe and it is an Digital payment alternative where financial institutions immediately shift funds from one account to another.

Far more Convenient Than the usual Paper Verify. No-one actually enjoys producing a bunch of paper checks and generating a visit on the write-up Business office to pay for expenditures. E-checks streamline this chore.

An eCheck, or Digital Examine, is sort of a digital Model of the paper Verify. It’s a means to fork out out of your examining account without the need of paper. In place of a paper Check out, you share your bank facts and payment information employing a type. This receives your payment able to go electronically.

The delivers that seem in this desk are from partnerships from which Investopedia receives compensation. This payment may possibly effect how and where listings surface. Investopedia isn't going to contain all features offered within the Market.

We offer 3rd-bash links as being a ease and for informational reasons only. Intuit will not endorse or approve these products and services, or maybe the viewpoints of those firms or companies or people. Intuit accepts no obligation for that accuracy, legality, or content material on these websites.

Alicia Silverstone Then & Now!

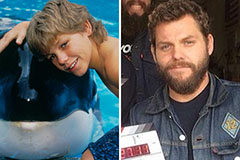

Alicia Silverstone Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Batista Then & Now!

Batista Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!